In the fast-paced world of stock trading, Penny Stocks are often a topic of interest for investors seeking high returns. In this here newly written blog, we will explore the potential of investing in three Government Debt-Free Penny Stocks that stand out in 2024, ya know!

Importance of Government Debt-Free Stocks

Investing in government debt-free stocks offers stability and reduced risk, ya know? These stocks are backed by financially secure entities, providing a safer investment avenue compared to those burdened with all that debt stuff, Understanding the benefits and risks associated with penny stocks is, ya know, like super crucial for making informed investment decisions.

Company Profile: NHPC Limited

Overview of NHPC Limited:

NHPC Limited, an Indian power company, specializes in making hydroelectric power generation happen. With a capacity of over 6,434 MW, NHPC has a really strong presence in the energy sector, ya know? The company’s commitment to project management, providing consultancy services, and even trading power positions it as a key player in the market, ya know!

Financial Strength and Stability:

NHPC boasts a robust financial position with a revenue of INR 103 billion (TTM) and a net income of INR 38.98 billion, ya know? The company’s debt-free status enhances its stability, making it look all shiny and attractive for investment, ya know what I mean?

Analysis of NHPC’s Market Presence and Projects:

NHPC’s power stations, including Salal, Kishanganga, and Chamera, contribute significantly to India’s power grid, ya know? The company’s diversified projects and strong market presence make it a potential penny stock to watch out for, ya know?

Current Stock Price (As per Groww – 02.02.2024)

₹100.65 / Share

Company Profile: NBCC Limited

Overview of NBCC Limited:

NBCC Limited, a Navratna CPSE, is like a boss in the construction sector, ya know? From Project Management Consultancy (PMC) to Real Estate Development, NBCC has demonstrated its capabilities since, like, way back in 1960 or something, ya know?

Financial Performance and Growth:

With a market capitalization reflected in a share price of INR 169.95, NBCC’s financial growth has been, like, super substantial, ya know? The company’s top line touched INR 10,151.37 crore in FY2018-19, showcasing consistent growth over the years, like yo!

Notable Subsidiaries and Diversification Strategies:

NBCC’s subsidiaries, including NBCC Services Limited, NBCC Gulf LLC, and NBCC International Limited, reflect its commitment to, like, doing a bunch of different things and expanding internationally, ya know? These strategies contribute to its resilience as a debt-free penny stock or something like that.

Current Stock Price (As per Groww – 02.02.2024)

₹169.95 / Share

Company Profile: Rail Vikas Nigam Limited (RVNL)

Introduction to RVNL:

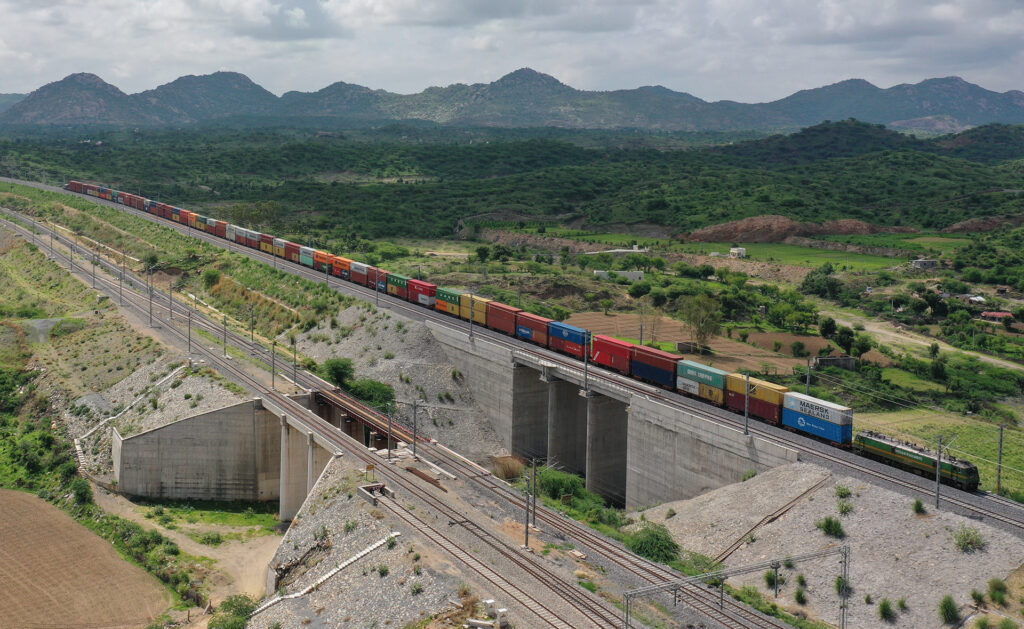

Rail Vikas Nigam Limited (RVNL) serves as the construction arm of the Ministry of Railways in India, so you know they build stuff and things. It was established in 2003, and since then, RVNL has been focusing on getting projects done and developing transportation infrastructure, ya know?

Role in Transportation Infrastructure Development:

As a ‘Navratna’ CPSE, RVNL plays a crucial role in developing all the railway infrastructure stuff on a fast-track basis, ya know? The company contributes significantly to, like, meeting the country’s surging infrastructural requirements and all that jazz.

Key Projects and Contributions:

RVNL’s involvement in projects related to railway equipment construction positions it as a strategic player in India’s transportation sector, ya know? Its current share price of INR 294.55 reflects investor confidence in, like, whatever it is they’re doing, ya know?

Current Stock Price (As per Groww – 02.02.2024)

₹294.55 / Share

Criteria for Selection

Metrics for Evaluating Penny Stocks:

Investors should consider essential metrics such as earnings growth, liquidity, and market trends when evaluating penny stocks, ya know? These criteria, coupled with a focus on government debt-free companies, provide, like, a comprehensive selection approach and all that jazz.

Government Debt-Free Criteria:

The criteria for determining a government debt-free stock involve analyzing the company’s balance sheet and all those financial statements stuff, ya know? A low debt burden enhances financial stability and minimizes like all that investment risk stuff, ya dig?

Risk Mitigation Strategies:

Despite the potentially cool rewards and all that, investing in penny stocks carries inherent risks, ya know? Implementing all those fancy risk mitigation strategies, like doing thorough research, diversification, and staying informed about market trends, is, like, super duper crucial for successful investments or whatever, ya know?

Investment Analysis

In-Depth Analysis of NHPC’s Growth Potential:

NHPC’s diverse hydroelectric projects, coupled with its strong financial position, position it as a growth-oriented penny stock, ya know? Investors may find value in its stable revenue streams and potential for further expansion in the energy sector, ya know?

Evaluation of NBCC’s Investment Prospects:

NBCC’s proven track record, coupled with its subsidiary-driven diversification, presents a compelling case for investment, ya know? Its involvement in real estate development and overseas operations adds to its growth potential, like yo!

Assessing RVNL’s Position in the Market:

RVNL’s strategic role in railway infrastructure development, backed by its government association, provides investors with, like, an opportunity to capitalize on India’s expanding transportation sector, ya know? Its current share price reflects market confidence in its future prospects or whatever.

Potential Risks and Challenges

General Risks Associated with Penny Stock Investments:

Investing in penny stocks involves inherent risks, including all that volatility and liquidity issues and, like, potential for fraud or whatever, ya know? It’s super crucial for investors to be aware of these risks and adopt like a cautious approach and all that jazz.

Industry-Specific Challenges:

Each company operates in a unique industry with its challenges, ya know? Understanding the specific risks associated with the energy, construction, and transportation sectors is like, super important for making informed investment decisions, or whatever.

Regulatory Considerations:

Penny stocks are often subject to, like, regulatory scrutiny and all those fancy guidelines, ya know what I mean? Investors should, like, be aware of the regulatory landscape and comply with, like, relevant guidelines to mitigate legal risks and all that stuff, ya know?

Conclusion

Summary of the 3 Best Govt-Debt Free Penny Stocks:

NHPC Limited, NBCC Limited, and Rail Vikas Nigam Limited stand out as promising government debt-free penny stocks in 2024, ya know? Each company’s unique strengths and growth potential make them noteworthy candidates for investors seeking, like, opportunities in the stock market, ya know?

Investment Recommendations:

While each investment decision should be based on individual financial goals and risk tolerance, the analysis suggests that these three companies, like, present compelling opportunities for investors seeking government debt-free penny stocks or whatever.

Future Outlook for Penny Stock Investments in 2024:

The outlook for penny stock investments in 2024 is influenced by various factors, including economic conditions, industry trends, and global events and all that jazz. Staying informed and adapting to market changes will be, like, the key for investors navigating the dynamic stock market landscape, ya know?